Top Coinbase Execs accused of misleading Shareholders

PLUS: 🇺🇸 Sen. Warren and Sanders want crypto out of banks, 🇮🇷 Iran uses digital assets for imports saying "widespread use soon," & 2 Pro-Crypto Candidates in next week's House Primaries

Web3’s most important weekly news in Government and the Courtroom, alongside political profiles, and additional insight.

Are you an expert in Compliance, HR, Legal, Tokenomics, Governance, Accounting, Tax, Policy or Regulation? Apply here!

Key Reads

🗽 - Pro-Crypto Congressional candidate Michelle Bond enlists FTX Exec boyfriend for campaign.

Michelle Bond, CEO of the Association of Digital Asset Markets and NY Congressional Candidate, received $115,000 — back-channeled through 2 Super PACs — from her boyfriend, FTX Co-CEO Ryan Salame. He frequently appears on the campaign trail with her.

Why it Matters: While not illegal, Salame/Bond’s connection continues to emphasize the industry’s involvement in politics. It also shows a coordinated network of crypto super PACs, whose alignment and connections obscure their money and influence.

Go Deeper: Learn more about Michelle Bond (R-NY) and A.D.A.M. from our profiles.

Zoom Out: In May, FTX’s charitable, nonpartisan behavior helped double crypto industry political donations from the first 15 months of primaries.

In Government — (Regulation/Policy)

by Lucy Pappas

🇺🇸 - Senators Warren and Sanders want crypto out of banks.

In an open letter to the Office of the Comptroller of the Currency, Senator Warren (D-MA) and Senator Sanders (I-VT) asked the comptroller to rescind a letter previously allowing banks to engage in crypto activities (i.e., crypto custody services, holding stablecoin reserves).

Why this Matters: Warren and Sanders cited Terra, Three Arrows Capital, Celsius, and Voyager as prime examples of recent market turmoil — demonstrating how the fallouts from crypto winter are inspiring more calls for regulation.

🇮🇷 - Iran imports $10M order with crypto and announces ‘widespread’ use in foreign trade by September’s end.

Iran’s Deputy Minister of Industry tweeted confirmation that the Islamic republic made its first foreign import with crypto on Tuesday. No details were shared on the crypto used or the goods imported — only plans to grow use in foreign trade by next month.

Why this Matters: Using crypto may allow Iran to bypass sanctions the U.S. imposes on them, and has, for the past 4 decades. U.S. businesses have been prohibited from conducting business in or with Iran.

🇹🇭🇦🇺 - CBDC pilot programs in Thailand and Australia.

The Bank of Thailand announced they will pilot a CBDC by the end of the year. Australia’s Central Bank also plans to test a CBDC soon, in a controlled environment (where a portion of users' financial assets are separated from the rest).

Why this Matters: Countries around the world (the IMF reported 100 in February 2022) are testing and researching CBDCs. Slow rollouts are especially common, as countries are devoting more and more time to research and testing.

From the Courtroom — (Legal news in web3)

by Lucy Pappas

🇺🇸 - Lawsuit accuses Coinbase Execs of misleading Shareholders about Public Listing.

The lawsuit filed in Delaware, where Coinbase incorporated, claims company executives made “false and misleading statements” in its SEC registration form, prior to its April 2021 direct listing. The complaint states Coinbase:

Violated the ”full and fair disclosure of the character of securities sold in interstate and foreign commerce,” as required in the Securities Act of 1933.

Allowed investors to buy shares directly on the Nasdaq, without intermediaries like Wall Street investment banks.

Misrepresented the success of their “flywheel” — citing Coinbase’s platform crashes when volume increased.

Why this Matters: The case adds to the weight Coinbase is already under with its many recent litigations. Further, the suit names directly high-profile officers like CEO Brian Armstrong, board member Marc Andreessen, and CFO Alesia Haas.

🇺🇸 - Grayscale lawyers up amidst trial with SEC.

As Twali Wrapped reported in July, Grayscale Investments is suing the SEC for rejecting their spot Bitcoin ETF. Now, Grayscale’s team has hired Obama's former Supreme Court lawyer to take on the regulatory body.

Why this Matters: The SEC has rejected numerous Bitcoin ETFs this year. While this case could drag on for years, Grayscale’s new legal power sets a more aggressive tone in the fight for crypto ETF adoption.

🇺🇸 - 70k XRP holders join Ripple v. SEC class action lawsuit.

Back in 2020, the SEC sued Ripple Labs for holding an initial public offering (IPO) of XRP, which they alleged was an unregistered security. Ripple fought back, responding that the SEC’s decision to file a lawsuit hurt investors.

Why this Matters: Ripple v. SEC has been a drawn out case marked by delay tactics from the SEC and hundreds of tweets from John Deaton, who first filed the suit. This support from XRP holders may help him finally end the legal back and forth.

Crypto Candidate profiles for upcoming Primaries

by Max Moncaster & Justine Doughty

Up to midterms, Wrapped will be profiling candidates supportive of crypto either from recent or upcoming primaries.

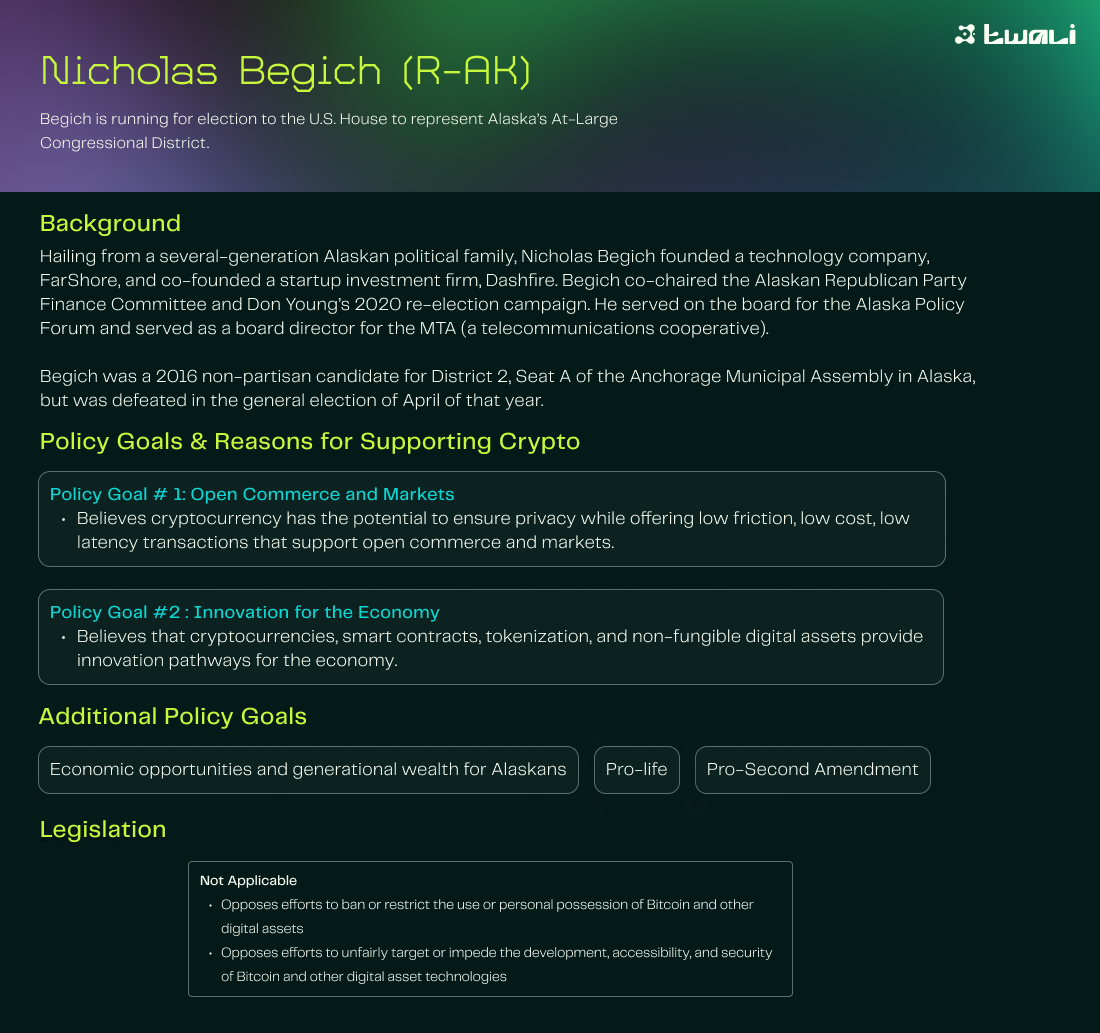

This week, we turn to the far-reaches of America with house candidates Patrick Branco (D) from Hawaii and Nicholas Begich (R) from Alaska. With their primaries coming up next week — August 13th and August 16th respectively — we assembled information on their backgrounds, why and how they support crypto, and their policy goals overall. Read more below:

Sources for Patrick Branco:

Sources for Nicholas Begich:

What'd you think of this Wrapped?

Your feedback helps us improve the letter. Click on a link to tell us how we did and/or what you'd like us to cover: