New York Wants its Whistleblowers

PLUS: 🇺🇸 POTUS Gets Crypto Advisor, 🇺🇸 CFTC to be Primary Crypto Regulator, 🇸🇬 Singapore Consults Public on Stables & 2 Pro-Crypto Candidates from House Primaries

Web3's Most Important Weekly News in the Government and the Courtroom, alongside Political Profiles and Additional Insight.

Are you an expert in Compliance, HR, Legal, Tokenomics, Governance, Accounting, Tax, Policy or Regulation? Apply here!

Read of the Week

🇨🇱 - Stablecoins a Haven for Chileans Amidst Record High Inflation.

Chile’s inflation rate has reached 12.5% (a 28 year high) amidst political uncertainty. Stablecoin serve as a cheaper alternative to opening dollar-denominated bank accounts, and have increased 50% on Chilean crypto exchanges in the last 3 months.

Why this Matters: We’re seeing stablecoins serve two primary purposes outside the U.S:

Guarantee the ability to exchange to alternative currencies that prove to be more reliable stores of value (i.e. dollars) if a country’s currency becomes unfavorable due to the state of its economy.

Ensure the public access to such currencies since they live on the blockchain rather than in a country’s central bank, regardless of circumstances of a regime.

The Bigger Picture: The Role CBDCs Could Play in Bankruns like that in China and Nigeria Makes Dollars Illegal.

Go Deeper. What’s the Difference between Stablecoins and CBDCs?

In Government — Web3 Regulation/Policy News

by Lucy Pappas

🇺🇸 - Bipartisan Senate Bill Proposes CFTC to be Primary Crypto Regulator.

Senate Agriculture Committee Senators Debbie Stabenow (D) and John Boozman (R) introduced a bill that places most crypto-related regulatory oversight in the hands of the Commodity Futures Trading Commission (CFTC).

Why this Matters: The bill defines “digital assets” (i.e., bitcoin, ether) as a commodity — counter to the SEC’s claim that many cryptocurrencies are securities.

Sounding the Alarm: Chris Giancarlo, the CFTC’s ex-Chairman (2014-2019), expressed concern that the regulatory standards proposed in EU’s MiCA make U.S. crypto innovation difficult. He urged U.S. policymakers to push regulation along.

Go Deeper: CFTC Announces New Crypto Division.

🇺🇸 - President Gets Personal Crypto Advisor.

Congress passed the Chips and Science Act last week, bolstering semiconductor production in the U.S. The bill also established the Digital Asset Advisor to President—a designated crypto advisory role for the Biden administration.

Why this Matters. Placing a blockchain-expert inside the president’s advisory circle goes to show the legal and political weight of crypto, and the White House’s interest in (or concerns about) crypto adoption.

🇺🇸 - California Unbans Crypto Campaign Donations.

Back in May, California’s Fair Political Practices Commission (FPPC) proposed two rules for crypto donations to political campaigns. They recently voted on the proposal, deciding that CA residents can donate crypto.

Why this Matters. Individuals can donate in BTC, ETH, etc., but campaigns must immediately convert crypto into cash, and donors must provide their name, address, occupation, and employer. Quite the catch.

🇸🇬 - Singapore Consults Public on Stablecoin Review.

Currently in the process of reviewing stablecoin regulation — like how to regulate reserve requirements for stablecoin issuers — the Monetary Authority of Singapore (MAS) plans to consult the public before finalizing any rules.

Why this Matters: Such collaboration between government and industry affords not only the best outcome, but also serves as a role model for other countries to turn to when it comes to the process of deliberating over crypto regulation.

Take Them to Court — Web3 Legal News

by Lucy Pappas

🇺🇸 - SEC Charges Forsage for Crypto Ponzi Scheme.

The SEC charged crypto platform Forsage with fraud, calling their method of raising $300 million a ponzi scheme. Several American citizens linked to the scheme were charged, but not Forsage’s founders — since they hail from Russia, the Republic of Georgia, and Indonesia.

Why this Matters: With this being an international case, it could raise calls for creating an international agency on crypto-related crime.

🇺🇸 - New York Attorney General Calls for Industry Whistleblowers.

NY State Attorney General Letitia James is calling on consumers affected by crypto-related fraud (think Celsius, Voyager, 3AC) to report incidents to the Investor Protection Bureau.

Why this Matters: As efforts to regulate crypto stall, calls to the public may appear to be the next best option for government officials looking to enact some oversight of the industry.

🇬🇧 - Law Commission of England and Wales Proposes Digital Assets are Distinct Class of Personal Property.

This Commission published a series of proposals, one of which legally defines “digital assets” (any asset that is represented digitally or electronically) as their own class of personal property.

Why this Matters: While this legal definition would apply to a wide range of assets (including tokens and NFTs), it has major ramifications for legal reform on digital asset ownership, control, transfers and transactions.

Crypto Candidate Profiles for August Primaries

by Justine Doughty (Adam Hollier) & Max Moncaster (French Hill)

Up to midterms, Wrapped will be profiling candidates welcoming of crypto either from recent or upcoming primaries or politicians with significant support of crypto.

This week, we look at Adam Hollier (D), who ran for House in Michigan’s Tuesday (Aug. 2nd) Primary, and received donations from FTX CEO Sam Bankman-Fried’s PAC, Protect Our Future PAC. He also received support from Web3 Forward PAC.

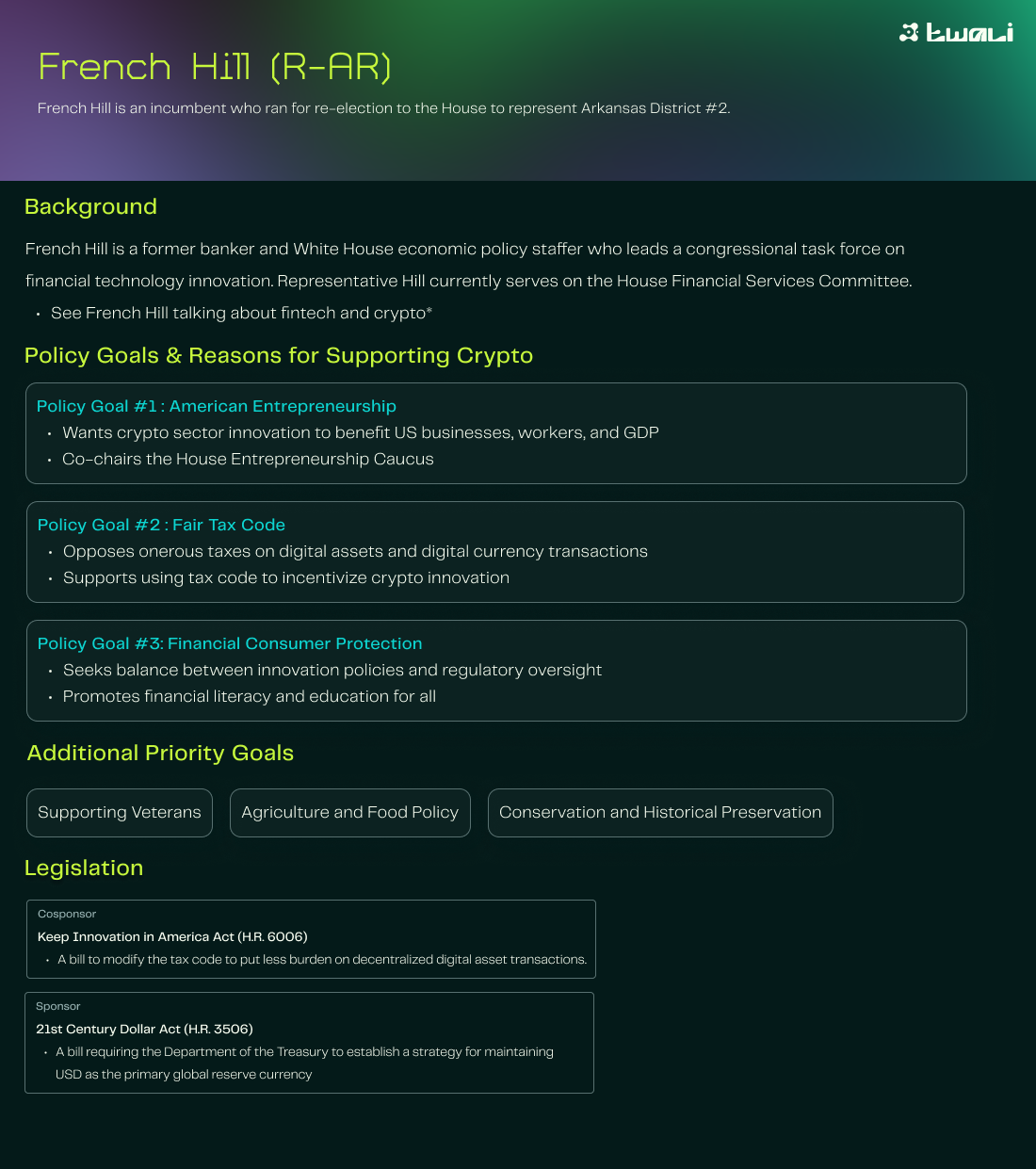

Alongside Hollier, we profile French Hill (R). Hill also ran for House in Arkansas’s Primary and, according to HODLPac, has been involved in pushing pro-crypto legislation. Read More Below:

Sources for Adam Hollier:

Adam Hollier’s Website

*French Hill on Fintech and Crypto

Sources for French Hill:

What'd you think of this Twali Wrapped?

Your feedback helps us improve the letter. Click on a link to vote and/or tell us what you'd like us to cover: